Table of Contents

One of the most important concepts to grasp in making informed decisions in forex trading is the secondary top, which plays a crucial role in identifying potential reversals or the end of a bullish trend.

What is a Secondary Top?

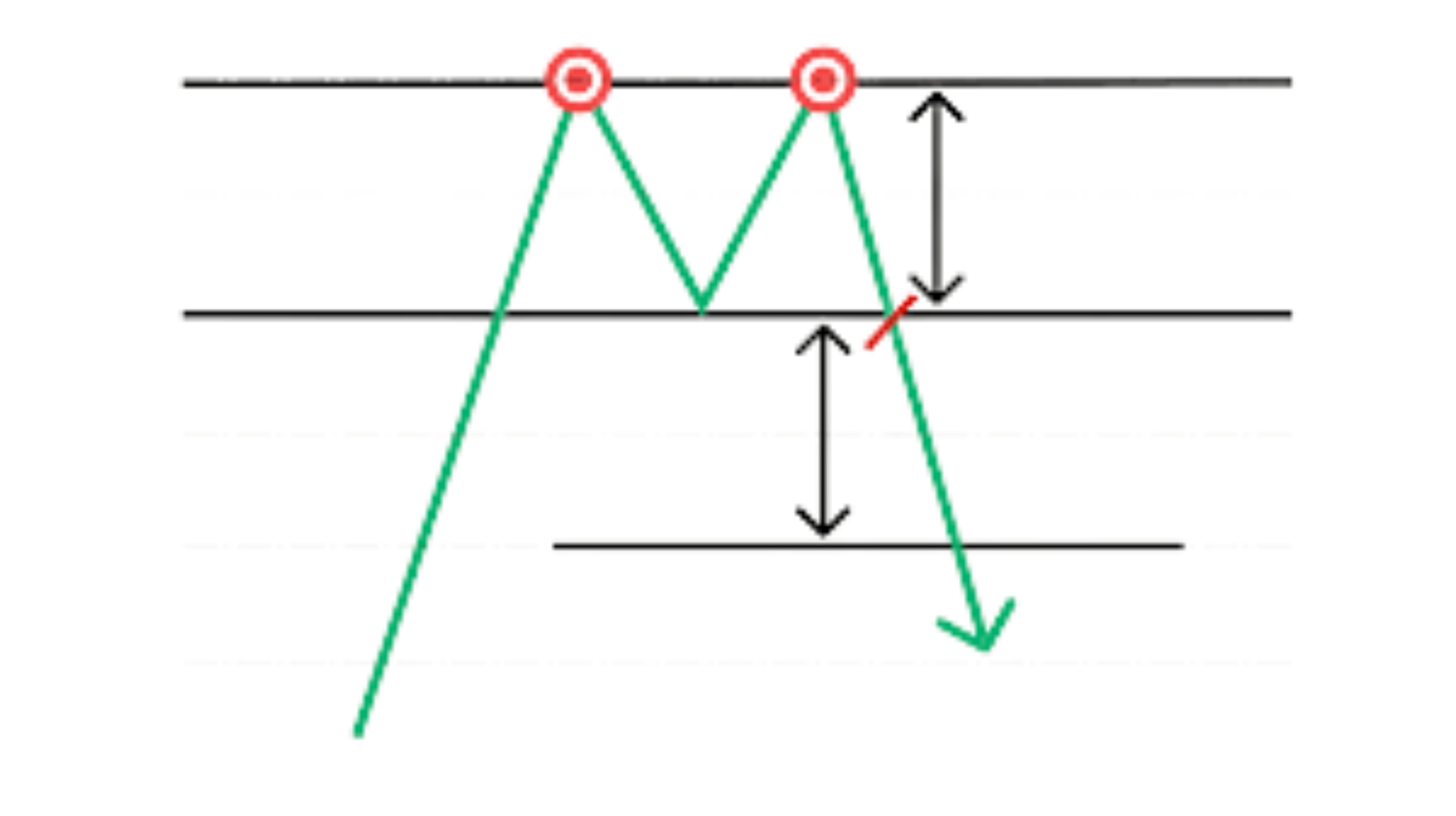

It is a peak that occurs after the initial top (the primary top) in an uptrend. It is often part of a double top pattern or a broader consolidation phase. This second top typically forms when the market attempts to push higher but fails to break through the previous high, signaling a loss of upward momentum.

How to Spot a Secondary Top

Traders can spot it by watching for the following characteristics:

- Formation of two peaks: The price moves up, forms a top, then dips before rising again to form a second peak, which is typically lower than the first.

- Volume patterns: The volume tends to decrease during the formation of the second peak compared to the first, indicating weakening buying pressure.

- Price action: The inability of the price to break the first top suggests that the market may be losing its bullish strength, which could indicate a reversal or consolidation.

Why It Matters

The secondary top is a key signal in technical analysis. It suggests that the market could be preparing for a trend reversal, making it an important point for traders to consider entering short positions. A break below the support formed between the two peaks often confirms the bearish trend.

Conclusion

By identifying the secondary top, traders can gain valuable insight into market dynamics. It is an important indicator for recognizing the potential end of an uptrend, allowing traders to adjust their strategies and mitigate risks.