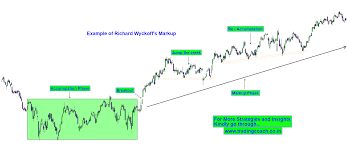

The Markdown Phase in forex trading refers to the period when the price of a currency pair begins to decline after reaching a peak. This phase follows a price rally and signals the shift from an uptrend to a downtrend. It is characterized by a series of lower lows and lower highs, which are key indicators of a bearish market.

Traders often identify the Markdown Phase after a market peak or consolidation, where buying pressure weakens, and selling pressure takes over. This phase plays a critical role in the market cycle, offering opportunities for short-selling or other strategies that benefit from falling prices.

Key Characteristics of the Markdown Phase

- Price Decline: The market experiences a downward trend with decreasing highs and lows.

- Shift in Market Sentiment: The overall market sentiment shifts from bullish (optimistic) to bearish (pessimistic).

- Lower Lows & Lower Highs: A consistent pattern of lower lows and lower highs forms, indicating ongoing downward movement.

Understanding the Markdown Phase helps traders better time their entries and exits, ensuring they make informed decisions during market downturns.